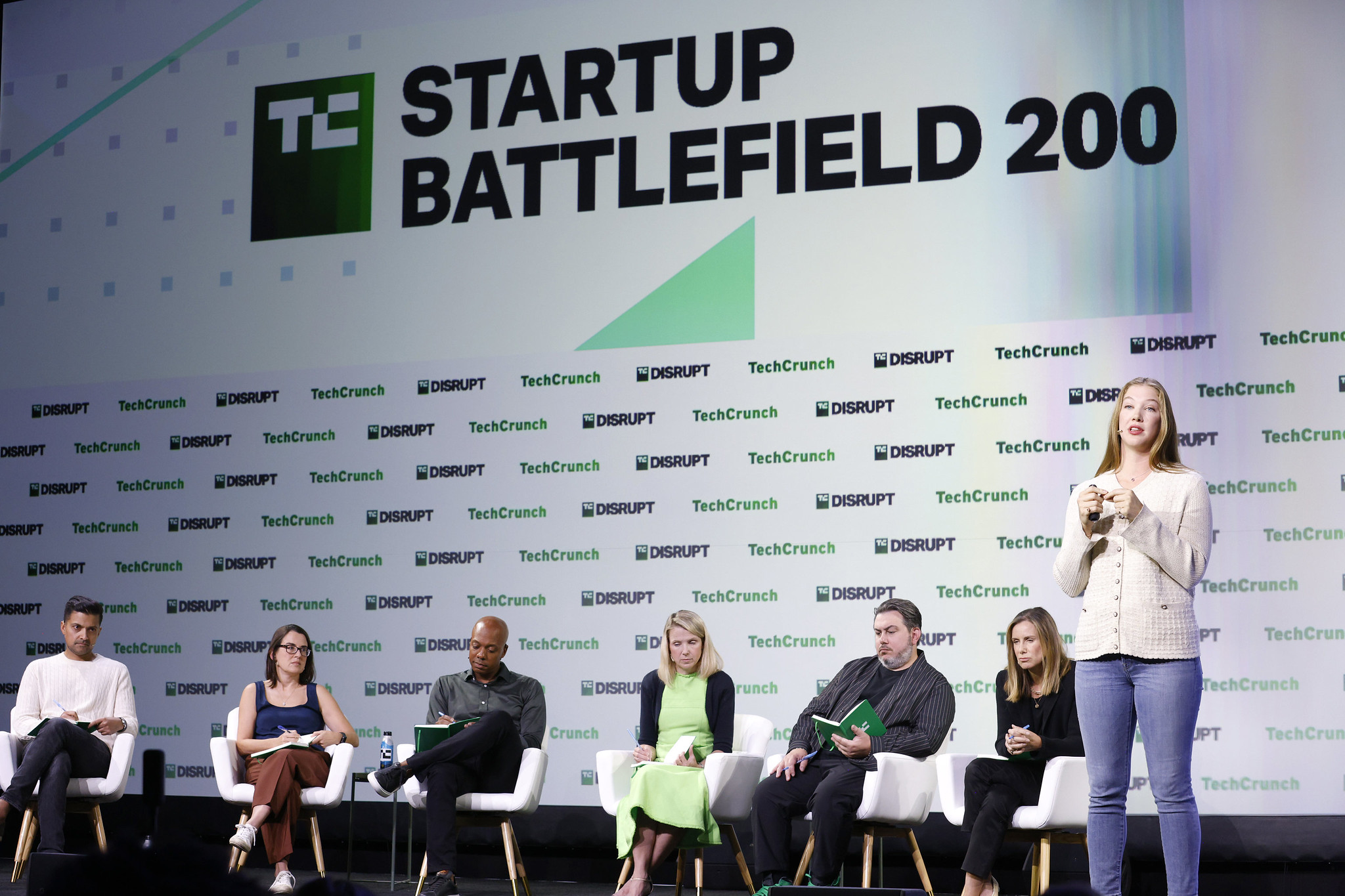

Last week at TechCrunch Disrupt (recaps coming soon), I spent less time than usual in the green room where staff and speakers work behind the scenes, and spent hours walking around Moscone Center.

More than 10,000 people passed through the conference hall over three days: I moderated three investor panels and a Q&A, but I must have spoken with at least 30 early-stage founders.

No one I met said they were looking for “thought leadership” or scorching hot takes: Almost everyone wanted actionable advice that would help them fundraise, build and scale.

Full TechCrunch+ articles are only available to members.

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription.

Six out of the seven VCs I surveyed this month included their contact details, so getting in touch with a tech investor is the easy part. The hard part is crafting a story about your startup that’s so convincing, they’ll recognize the value in your idea and wire you some cash.

Here’s who I spoke to:

- Maria Buitron, principal, Piva Capital

- Karl Alomar, managing partner, M13

- Raja Ghawi, partner, Era Ventures

- Anamitra Banerji, managing partner, Afore Capital

- Mukaya (Tai) Panich, CIO and CEO, SCB 10X

- David Phelps, founder, chairman and CEO; Merlin Ventures and Merlin Cyber

- Kavita Gupta, founder and general partner, Delta Blockchain Fund

Fun fact: Today is my fourth anniversary at TechCrunch! If this were a startup, I’d be fully vested by now.

Thanks very much for reading TC+,

Walter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

Bootstrapping is cool once again

Image Credits: M. Reinertson/The Photo Group for TechCrunch / Flickr

Several factors combined to dampen investor interest in early-stage startups over the last year and change, leading more founders to explore funding alternatives.

Dominic-Madori Davis spoke to Hussein Yahfoufi (product lead at Arta Finance) and Healthie founder Erica Jain last week at Disrupt to get their advice for connecting with angels and conserving cash.

“Bootstrapping isn’t necessarily an all-or-nothing [endeavor],” said Jain. “It’s about thinking through the long term and being in control about how you think about the capital journey of your business.”

Six imperatives for building AI-first companies

Image Credits: wabeno (opens in a new window) / Getty Images

I’m reluctant to use terms like “paradigm-shifting” to describe generative AI, but it’s hardly a stretch to observe that this emerging technology is quickly changing how we interact with data.

Even so, there are major differences between AI-first and AI-enabled companies, write Morgan Cheatham and Steve Kraus at Bessemer Venture Partners.

“AI-first companies require deep AI research acumen, investors willing to take a long view, materially more capital, and potentially less conventional business models than AI-enabled peers.”

Investors taking 30% of a startup in a round are being short-sighted

Image Credits: Haje Kamps (opens in a new window) / TechCrunch (opens in a new window)

How much equity do founders tend to keep after their startup goes public?

According to Blossom Street Ventures managing partner and founder Sammy Abdullah, their average post-IPO ownership stake is 20% and the median is 15%.

“Great founders know that equity is extremely valuable — it’s the single most valuable asset in a business, in fact,” writes Haje Jan Kamps.

“Put simply, founders who allow themselves to be diluted too much by early-stage investors aren’t great founders.”

Creating strategic defensibility as an early-stage startup

In the first column of a four-part series, Startup Battlefield editor and director of community Neesha Tambe hosted a master class on strategic defensibility with Mike Ghaffary, general partner at Canvas Ventures.

In the first column of a four-part series, Startup Battlefield editor and director of community Neesha Tambe hosted a master class on strategic defensibility with Mike Ghaffary, general partner at Canvas Ventures.

“In this session, Ghaffary outlined the important components of startup defensibility, the key strategic advantage buckets, and what startups can do to stay competitive as they build and scale,” she writes.

Ask Sophie: How would a government shutdown affect the H-1B visa process?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

Since our new hire wasn’t selected in the H-1B lottery, we are in the process of getting a cap-exempt H-1B visa. Our new hire is currently living abroad.

How will the H-1B visa process be affected if the U.S. government shuts down?

— Exceptional Employer

Get the TechCrunch+ Roundup newsletter in your inbox!

To receive the TechCrunch+ Roundup as an email each Tuesday and Friday, scroll down to find the “sign up for newsletters” section on this page, select “TechCrunch+ Roundup,” enter your email, and click “subscribe.”

To receive the TechCrunch+ Roundup as an email each Tuesday and Friday, scroll down to find the “sign up for newsletters” section on this page, select “TechCrunch+ Roundup,” enter your email, and click “subscribe.”

Click here to subscribe

Pitch Deck Teardown: Point.me’s $10M Series A deck

Image Credits: Point.me (opens in a new window)

Last year, real-time flight rewards search engine point.me raised a $2 million seed round to scale its service, which helps travelers reveal and optimize reward travel options.

This week, Haje Jan Kamps put their winning pitch deck on his dissection table:

- Cover

- Problem

- Problem impact

- “How it’s currently solved”

- Solution

- Value proposition

- Product benefits

- Product

- Product delivery

- Product screenshots

- Traction

- Press clippings

- Moat

- Team

- “Past investors”

- Closing

Ask Sophie: What are your top immigration tips from TechCrunch Disrupt 2023?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

I wasn’t able to make Disrupt this year.

What were your main immigration takeaways for founders and startups?

— Faraway Friend