When entrepreneur Stephen Chen’s mom began approaching retirement age, she was forced to borrow money from Chen — and Chen’s brother — to make ends meet. They wanted to help, but the siblings also wanted to figure out a more sustainable, long-term solution that’d help their mom retire without having to worry about finances.

Chen tried to get guidance from a financial adviser, but no one would take his mother as a client because her net worth wasn’t considered high enough. So Chen started building spreadsheets and financial models himself, doing his best to figure out how his mom could live the retirement lifestyle that she wanted.

“People like my mom lack the tools to look at their money holistically and strategically so they can make informed decisions, monitor their financial situation, understand which levers to pull and when and make the connection between the choices they make today and the long-term ramifications to their plan,” Chen told TechCrunch. “There’s a confluence of factors that may alter the future of financial planning and advising.”

It was after Chen helped his mom lower her expenses, figure out when to claim Social Security, decide when to downsize and take other steps to become financially independent that Chen realized lots of other older Americans were facing the same challenges.

So Chen founded NewRetirement, a Mill Valley-based company building software to help people create financial retirement plans. Today, NewRetirement’s direct-to-consumer products power financial planning for 70,000 users managing close to $100 billion in their own financial plans, according to Chen.

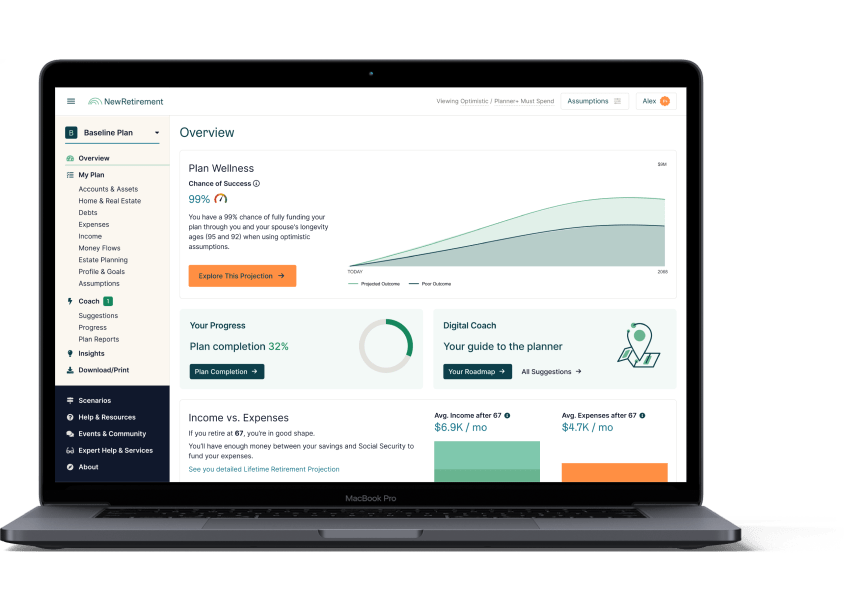

“Our models go beyond savings and investments, taking into account all of the other factors in a person’s life, from home equity, healthcare costs and taxes to Medicare and Social Security,” Chen said. “Every time a user makes a change, we run thousands of simulations in order to help them optimize their plan … We account for thousands of different scenarios, enabling users to confidently map out accumulation and decumulation projections with digital guidance.”

NewRetirement is Chen’s second startup after Embark, an online college search and admissions tool he launched in 1995. And, like Embark, Chen sees NewRetirement as a digital solution to a transition faced by millions of Americans.

“120 million Americans over age 50 hold 80% of the wealth in this country,” Chen said, “But running out of money remains a top 10 fear, with nearly half of Americans saying they are worried about it.”

NewRetirement’s platform uses predictive modeling and data analytics to help users suss out the right savings approaches. Image Credits: NewRetirement

Indeed, the majority of Americans — as many as 65%, per Charles Schwab’s Modern Wealth Survey 2023 — have no formal financial plan. And while 37% of respondents say that they work with a financial adviser, two-thirds of Americans believe that their financial planning needs improvement, according to Northwestern Mutual’s Planning and Progress Study 2023.

NewRetirement, which began as a consumer offering and in 2021 expanded to the enterprise, charges $120 per year for access to a suite of tools, calculators, recommendations and scenario comparisons and ~$1,500 per year for check-ins with a certified financial planner. In addition, NewRetirement sells a subscription-based private label version of its tools aimed at financial advisers.

Now, you might wonder, what makes NewRetirement different from startups like Retirable, which similarly provides an array of retirement planning tools and access to asset managers? Chen asserts that NewRetirement is one of the few — and perhaps only — financial planning platform that serves consumers as well as advisers and workplaces.

“Our core innovation is allowing anyone to create a plan with industrial-strength tools, enabling advisers to collaborate with the end user and making this available at scale through enterprise partners who bring it to their customers,” Chen said. “As more financial services companies see their offerings like investment management become commoditized, there’s huge value in helping clients and prospects think about their money holistically. By offering self-directed digital planning to clients versus starting with a human adviser, they can scale and serve any number of users, learn about them, help them make good decisions and position their products and services more effectively.”

Chen says that about 70% of NewRetirement’s revenue is enterprise presently, with the remaining 30% coming from consumer customers. The platform has 20,000 individual subscribers and “several” wealth management clients as well as “multiple” enterprise customers including Nationwide, which recently expanded an existing partnership with NewRetirement.

That momentum no doubt helped NewRetirement to cinch its Series A funding round this month.

The company raised $20 million in a tranche that brings its total raised to $20.8 million, led by Allegis Capital with participation from Nationwide Ventures, Northwestern Mutual Future Ventures, Plug and Play Ventures, Motley Fool Ventures and others. Chen says that the cash infusion will be used to expand 50-employee NewRetirement’s enterprise products, scale up onboarding, accelerate R&D efforts and build capacity to meet future demand.

“With this new capital, we will have three to four years of runway,” Chen said. “That gives us time to continue to scale our enterprise partnerships and enhance our product. What’s more, the current downturn is enabling us to bring in incredible talent. We have a strong team in place and will expand headcount further this year.”