Backpack’s founders, who are building a crypto exchange and wallet, have experienced strong growth since launching in 2022. But the road wasn’t easy.

FTX co-led Backpack’s $20 million strategic investment round in September 2022. Less than two months later, in November 2022, FTX collapsed.

“We lost 80% of the operating capital on FTX. We spent all this time building this protocol and it was like an on-the-ground knockout and [we] needed to be resuscitated back to life,” Armani Ferrante, co-founder of Backpack and the NFT collection Mad Lads, told TechCrunch.

Not only did they lose their investment money and a major partner, but also the FTX collapse ushered in a crypto bear market that has only lately begun to bounce back.

Backpack made it through largely thanks to its supporters. “It’s a combination of product, community, social good will and timing that brought in an incredible group of people,” Ferrante said. “Since then it’s taken on a life of its own.”

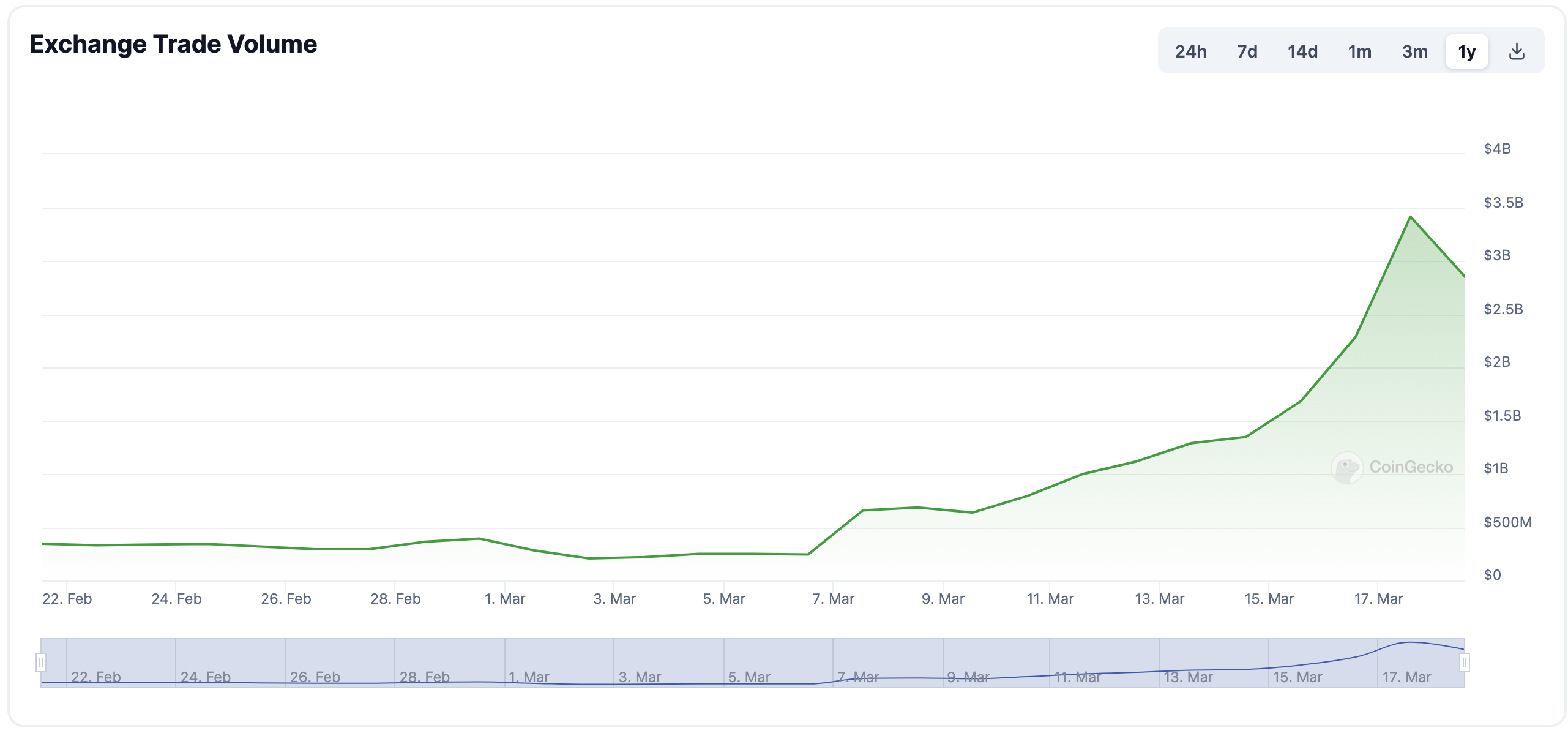

On Monday, its “Pre Season Phase 1,” aka the exchange’s beta phase, ended after a month and a few days. During that time frame, it traded over $27.5 billion in total volume and filled 259 million orders at about 5,000 per minute, according to the company’s posts on X. It also added 252,000 KYC’d users, bringing its total to 560,000 users.

The exchange’s trading volume peaked on Sunday at $3.66 billion and has a 24-hour volume of about $2.8 billion, according to CoinGecko data.

Image Credits: CoinGecko (opens in a new window)

“We have caught lightning in a bottle in a weird way, where people just started talking about Backpack as this new up-and-coming exchange and seeing the promises of a next-generation exchange that can learn from a lot of the lessons and mistakes that were made of previous exchanges,” Ferrante said.

There are a bunch of lessons to learn from FTX, Ferrante said. One of the foundational design goals for Backpack was to solve the problems exposed by FTX, he added

Unlike FTX, Backpack designed its exchange’s system to make sure that balances are controlled by independent entities, or nodes, that can collectively validate each other so that every order, cancellation, deposit, withdrawal and so on are checked. This is done in hopes that there’s no single point of failure and that the operations of the Backpack crypto exchange can be split up across multiple entities. “The industry has been forced to mature, for the better,” Ferrante said.

“The collapse of FTX was horrible, but looking glass half full, it’s like a phoenix rising from the ashes and we have to step up our game to solve the hard problems that weren’t being solved,” Ferrante said. “We’re taking the product in our own direction,” he added, and it’s going beyond an exchange and into other products too.

Backpack is also building out its crypto wallet and platform for xNFTs, which are a new token standard on the Solana blockchain that are similar to NFTs but are also a platform for web3 applications. This points back to the origin of the name Backpack, which was inspired by MMO games like World of Warcraft or RuneScape that provide users with backpacks to hold inventory. “In a [normal] wallet you have cards, some cash and coins, but a backpack can have everything, not just money, so we see this as a much more dynamic version of a wallet,” Ferrante said.

Mad Lads, one of the biggest Solana NFT collections out there created by Backpack, is also an xNFT, with a trading floor price of about 172 SOL, or $34,400, at the time of publication. “For us, we’re fortunate where our community is complementary to our business,” Ferrante said. “We wanted to build a product for them and make their life in crypto better.”

But Mad Lads isn’t the only xNFT out there, Ferrante said. For example, the NFT collection Solana Monkey Business has an xNFT with a newsletter that’s called the Banana Split and it’s regularly updated so when someone has the NFT on Backpack, they can access the newsletter directly in their wallet, he noted.

As for replacing FTX as an investor, that’s gone well, too. At the end of February, Backpack raised $17 million at a $120 million valuation in a Series A round led by Placeholder VC. Backpack recently expanded into the United Kingdom and has a presence in 11 U.S. states, Dubai and across the Asia-Pacific region. But this is just the beginning, Ferrante said. The team’s fresh capital will be used toward global expansion as Backpack wants to reach 95% of the world’s GDP by the end of 2024 “to compliantly serve customers.”

Going forward, it’s all about execution for Backpack on many different fronts. But product distribution is top of mind for the exchange, as it hopes to get into every country around the world.

“It’s one of those crazy things where it’s a winner take all market,” Ferrante said. “We want to seize the moment and given everything we talked about, that opportunity exists this year so we’re making the most out of everything.”