On-chain data shows the memecoin Pepe currently has 80% of its holders in profit. Here’s how Dogecoin, Bitcoin, and other top coins compare.

PEPE Is Among The Coins With The Highest Profitability Ratio Right Now

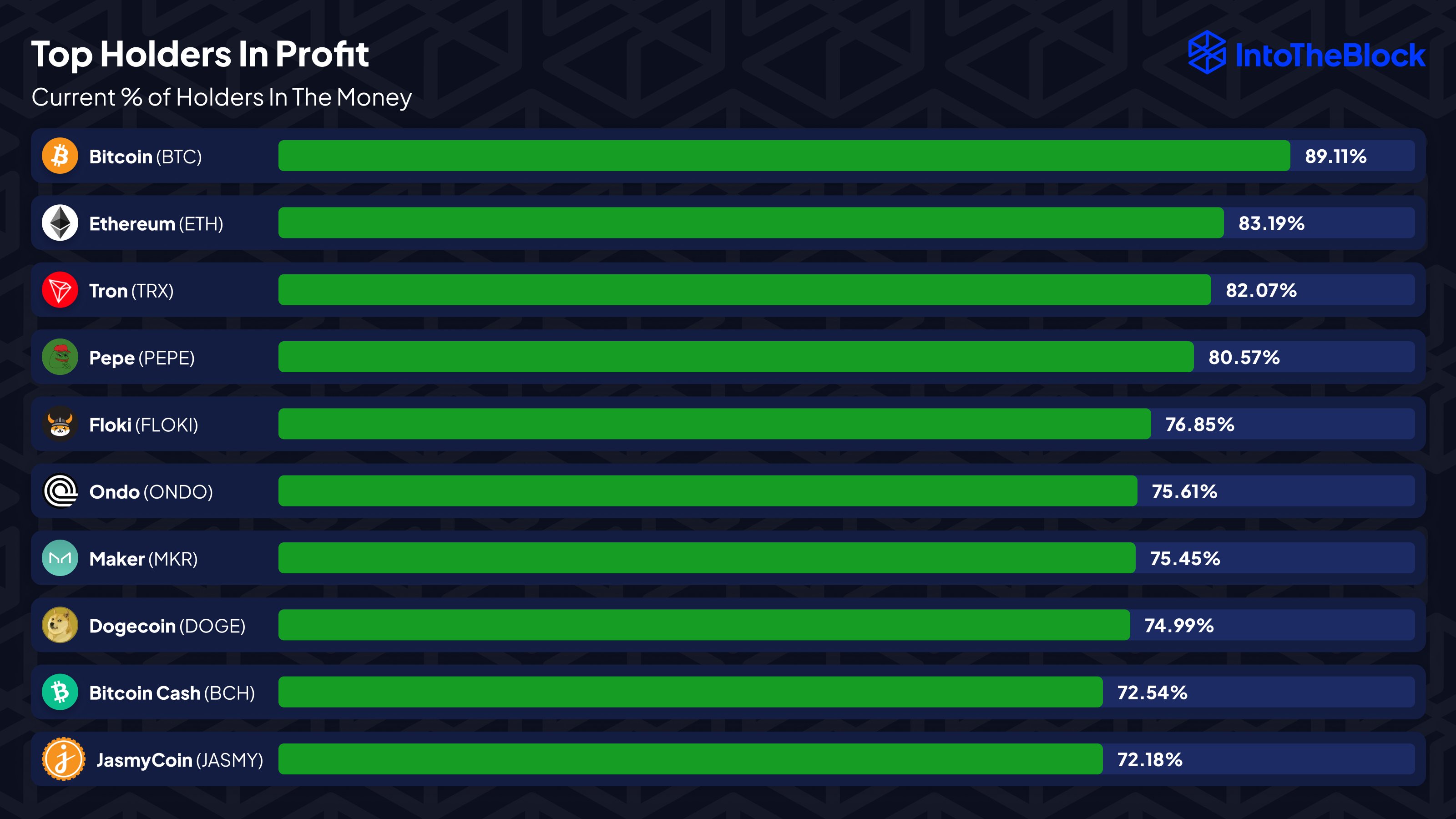

In a new post on X, the market intelligence platform IntoTheBlock has shared a chart that shows how the various top cryptocurrencies compare against each other regarding the percentage of holders carrying a net unrealized profit currently.

The analytics firm has determined these percentages using on-chain data; the transaction history of each address on a given network can reveal at what price it received and how many coins it received, based on which an average cost basis can be calculated.

Naturally, the addresses or holders with this cost basis below the current spot price are in the green. They would contribute towards the holders in profit metric for the blockchain.

Now, here is the chart posted by IntoTheBlock, which shows how this metric is looking at the moment for various assets in the sector:

As is visible above, Bitcoin (BTC) currently has the highest profitability ratio among the top coins, with more than 89% of its holders carrying gains. Ethereum (ETH), the second largest cryptocurrency by market cap, is also second on this list, with over 83% of the addresses in the green.

The gap between these two isn’t much right now, and the analytics firm thinks the Ethereum spot exchange-traded funds (ETFs) could push the asset to reach new highs.

The third cryptocurrency on the list is Tron (TRX), with around 82% of investors in profit. Interestingly, two memecoins make up for the rest of the top 5, but none are Dogecoin (DOGE), the original and largest meme-based token.

The two memecoins in question are Pepe (PEPE) and Floki (FLOKI), with around 80% and 77% holders above water, respectively. DOGE is further down the list, with the metric at 75%.

IntoTheBlock notes that this indicator data implies profitability is currently skewed towards large-caps and memecoins, with other altcoins waiting for breakthroughs.

Now, what’s the significance behind holders in profit for any cryptocurrency? Generally, the investors holding gains are more likely to sell their coins. As such, the probability of a mass selloff increases as more holders come into profits.

Because of this, corrections can become more probable when the percentage of addresses in the green increases. In this view, the top coins with lower profitability, like Dogecoin or Pepe, may have more room to run before hitting a wall than an asset like Bitcoin.

PEPE Price

Pepe is trading around $0.00001126 at the time of writing, down more than 8% in the last seven days.