Cardano (ADA) is trading above the critical $1 level, fueling optimism among investors anticipating further upside in the coming weeks. After a strong bullish run in recent weeks, the recent pullback appears to be a temporary pause in an upward trend.

Crucial on-chain data supports this outlook, indicating robust network activity that reinforces the bullish sentiment for ADA.

Related Reading

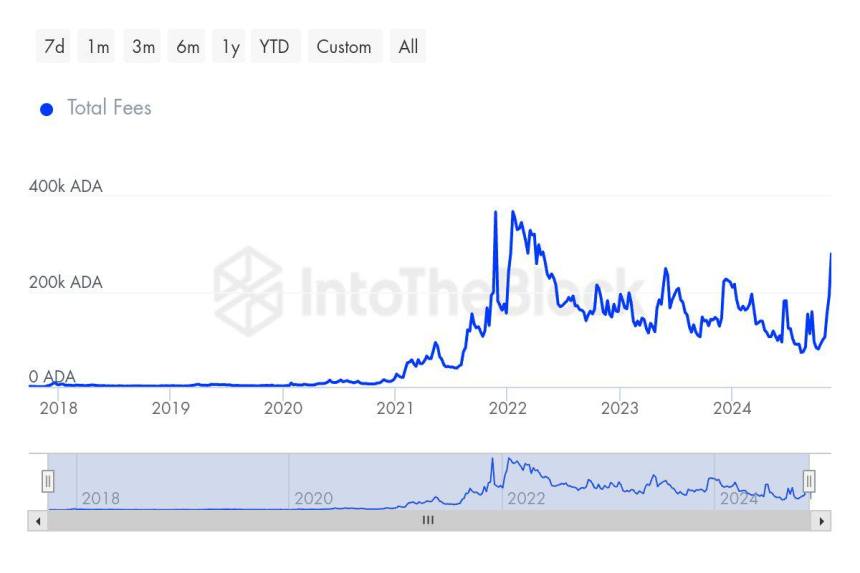

Key metrics shared by IntoTheBlock reveal over 840,000 transactions recorded on the Cardano network, with total fees amounting to 279,000 ADA. This data underscores growing usage and demand for the Cardano blockchain, adding to its fundamental strength. Such network activity often correlates with price appreciation, suggesting that ADA could soon maintain its momentum.

As ADA consolidates above $1, the market will closely monitor whether it can hold this key level and push higher. Investors and analysts are optimistic, citing the network’s increasing adoption and solid transaction metrics as critical factors driving its bullish outlook. The next few weeks could be pivotal for Cardano, with a sustained move above $1 likely signaling the continuation of its upward trend.

Cardano Activity Growing

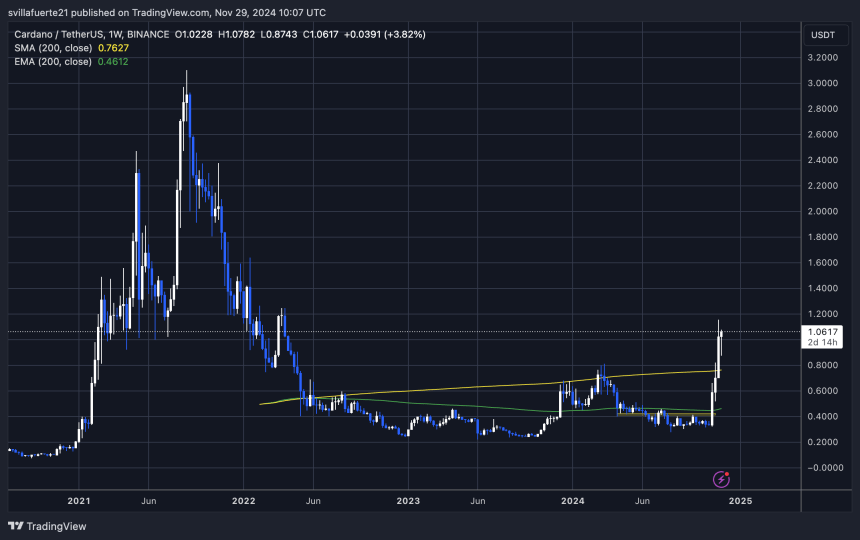

Cardano is trading at multi-year highs and looks poised to continue its impressive rally. After breaking through the critical $1 level at the start of this bull run, ADA has shown strong momentum, driven by increasing adoption and investor confidence. On-chain data shared by IntoTheBlock analyst C Thumbs highlights significant milestones, signaling sustained growth in the Cardano ecosystem.

The latest data reveals that Cardano recently surpassed 840,000 transactions, with total fees reaching 279,000 ADA. Notably, the last time transaction volumes and fees were this high was in March 2022. This resurgence reflects the growing utility of the Cardano blockchain, transitioning from being primarily speculative to demonstrating real-world value.

A closer look at holder trends further underscores this shift. From July 2022 until today, ADA has seen sustained growth in the number of holders, indicating increasing confidence in the blockchain’s long-term potential. Unlike previous cycles, where ADA’s price movements were driven primarily by speculation, the current rally appears underpinned by tangible network activity and adoption.

Related Reading: Bitcoin Holds Above $90K – On-Chain Data Reveals Key Demand Levels

As Cardano continues to gain traction, investors are focusing on the next significant supply level. With robust network activity and bullish sentiment prevailing, ADA appears ready to target new highs, reinforcing its status as a leading blockchain in the crypto space.

ADA Testing Crucial Supply

Cardano has experienced a remarkable 250% rally in less than a month, showcasing strong bullish momentum as it gains traction in the market. Currently trading at $1.06, ADA is approaching its yearly high of $1.15, a crucial resistance level that could define its next price trajectory.

If ADA successfully breaks above the $1.15 level, it could open the door to a significant rally targeting the next supply zones at $1.25 and potentially $1.60. Such a breakout would signal renewed investor confidence and sustained demand, further solidifying Cardano’s position as one of the most dynamic assets in the crypto space during this cycle.

However, there is a risk of further consolidation below the $1.15 mark. If ADA fails to hold momentum at this critical level, the price may pull back to test support at $1.00 or lower. Such a scenario could indicate a temporary pause in the uptrend, allowing investors and traders to reassess the market conditions.

Related Reading

As Cardano trades near these pivotal levels, market participants will closely monitor its price action to determine whether the rally can extend or if consolidation will define the short-term outlook for this rapidly rising altcoin.

Featured image from Dall-E, chart from TradingView