In a recent thread on X (formerly Twitter), renowned on-chain analyst Checkmate provided an analysis regarding the future trajectory of Bitcoin. Currently, the premier cryptocurrency hovers around the $60,000 mark, a pivotal moment that echoes historical patterns within the Bitcoin market cycle.

What Will The Next 6 Months Bring For Bitcoin?

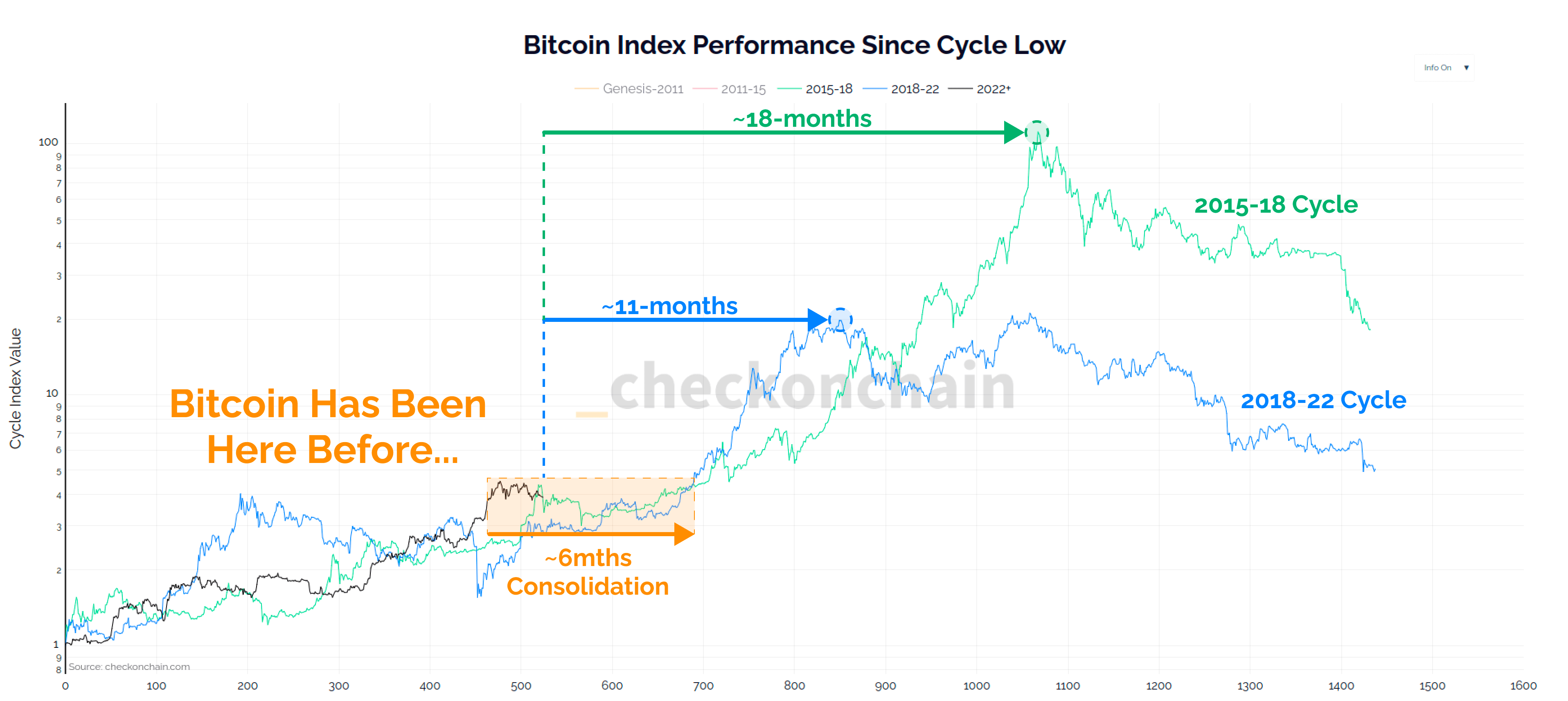

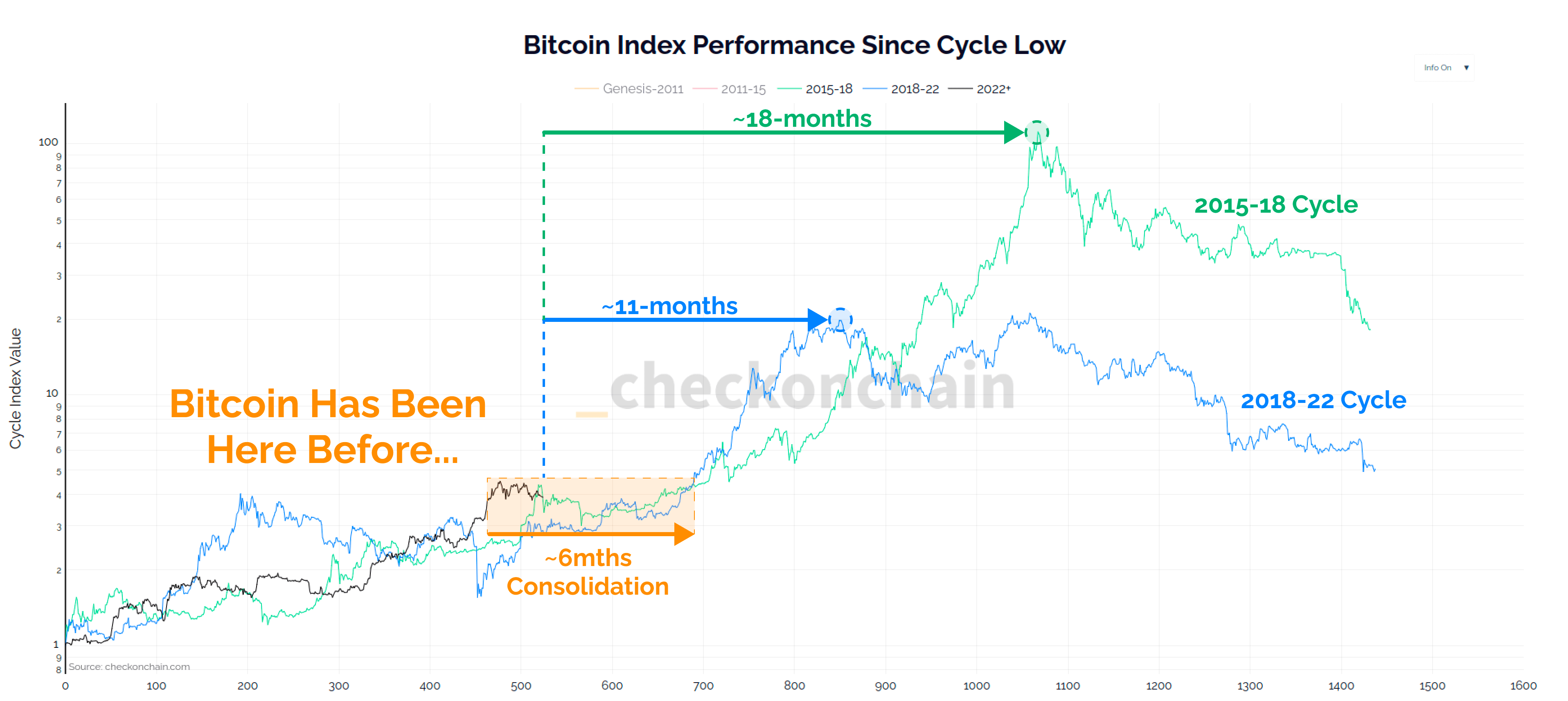

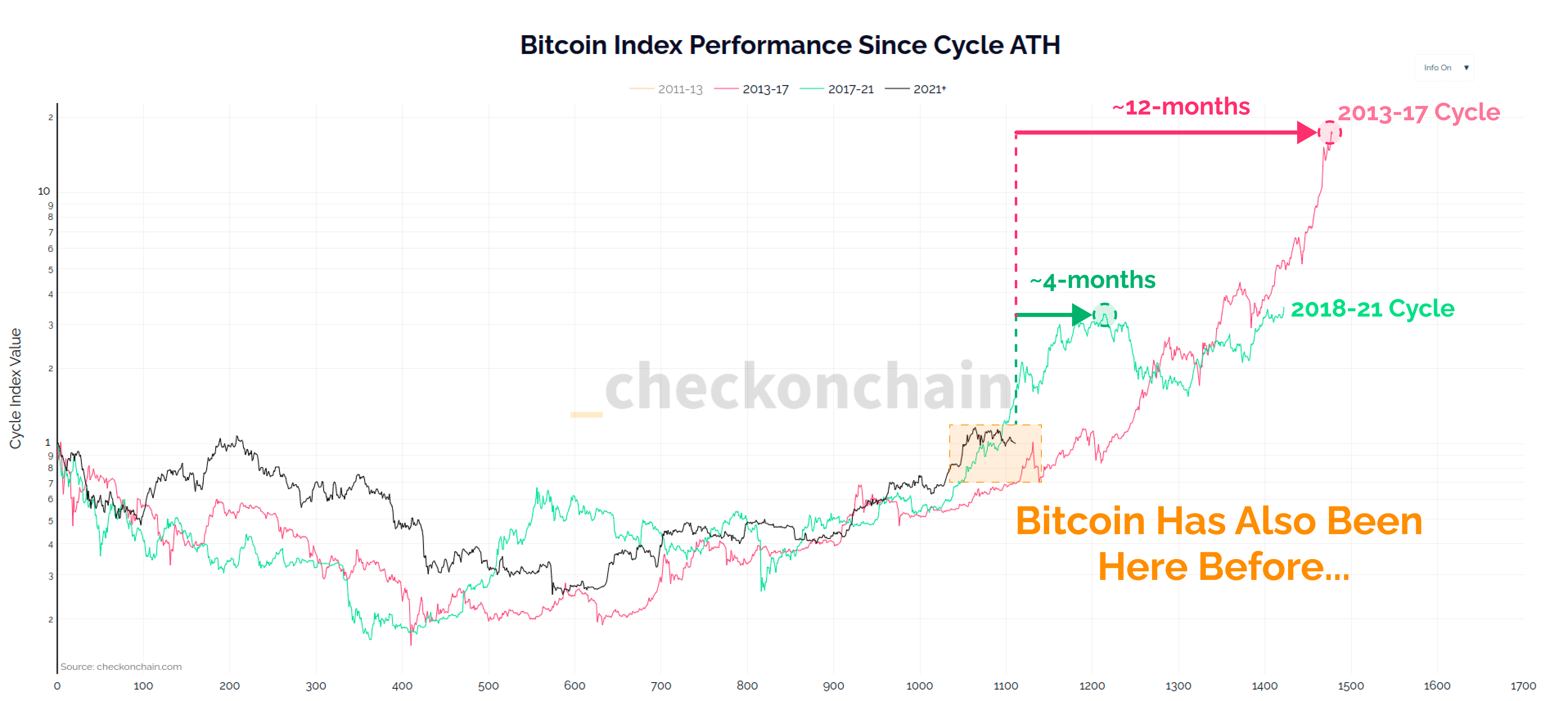

Checkmate argues that Bitcoin is positioned in a “chopsolidation” phase—a term coined to describe a stagnant yet volatile period. He suggests that this could last approximately six months, based on previous cycles, and potentially usher in a period of parabolic growth that could last between six to twelve months. “Bitcoin history tends to rhyme, and thus far, this cycle is no different,” Checkmate noted. “The song sung during the last two cycles paints around 6-months of chopsolidation ahead of us, followed by 6-12 months of parabolic advance.”

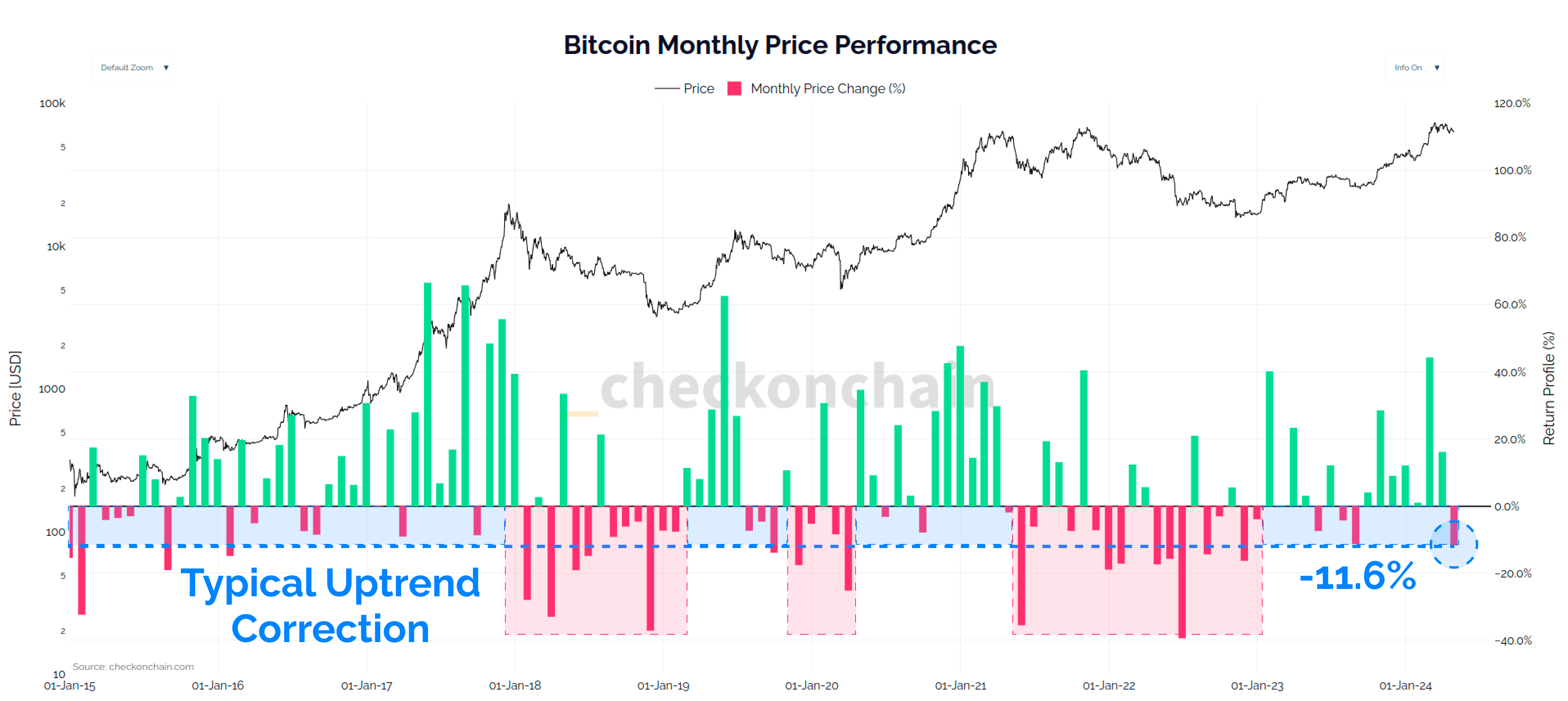

Supporting his analysis, Checkmate refers to April 2021 as a significant high point for Bitcoin for “many good reasons,” noting that despite a considerable monthly drop of over $8,250 in April, such movements are typical and often signify healthy market corrections. “It’s an -11.2% monthly pullback, and is extremely common during uptrends, and corrections are healthy and necessary,” he stated, reinforcing his confidence in Bitcoin’s resilience and potential for recovery.

Further statistical backing comes from historical data focused exclusively on Bitcoin halving years (2012, 2016, 2020, and 2024), which Checkmate used to illustrate that such month-over-month corrections are not outliers but rather common occurrences within the digital asset’s cyclical trends. The end of each year post-halving has historically shown strong performance, supporting the notion that the current price point could be a precursor to significant gains.

Sell In May And Go Away?

Checkmate also retweeted a post from Charles Edwards. The founder of Capriole Investments commented on the market’s unprecedented bullishness, implying that a deeper correction is to be expected.

“This is starting to get ridiculous. Bitcoin has not had a run like this since inception. We are now 1 day short of the record set in 2011 for days without a meaningful dip [more than 25%]. If you are not prepared to accept some downside in this asset class, you shouldn’t be here. Especially now,” said Edwards. His remark highlights the unusual lack of severe downturns in the market, suggesting that investors should be prepared for potential volatility.

In another post on X, Edwards added a cautious note to the otherwise optimistic outlook. He advised, “Sell in May and go away. This looks like distribution to me. As long as we trade below $61.5K, scenario (1) is technically more likely. A strong reclaim of $61.5K would give some hopes to the bulls for scenario (2). A flush would also be good for the sustaining continuation of the bull market, the sooner we get one, the better the long opportunities are.”

This perspective suggests a strategic withdrawal may be wise in the short term, implying that current market conditions might be more bearish than they appear and that a significant correction could potentially strengthen the market’s long-term prospects.

At press time, the BTC plunged to $57,691.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.